Normalization Turning from Holiday Specials to Business as Usual

By J.J. McCoy, Senior Managing Editor, New Frontier Data

It used to be that — apart from the unofficial cannabis holiday of 4/20 — the Thanksgiving bookends of Green Wednesday and Black Friday were perennially the two other biggest sales days for the cannabis industry. But as normalization takes hold and more state markets open up, that seems to be changing: In short, business is becoming more day-to-day usual than cyclical for cannabis retailers, who could benefit from adjusting their sales strategies accordingly.

For example, last year Green Wednesday ranked as the third-highest grossing sales day of 2021. But that wasn’t so this year, either in California’s long-time market or the more recent one in Michigan. In California, neither Green Wednesday nor Black Friday was the best-selling day in November; that was found the previous Friday, the 18th, which itself did not see receipts spike far beyond a normal Friday (typically the best day of the week for cannabis sales). As a result, the holiday receipts seemed a bit more ho-hum than ho-ho-ho.

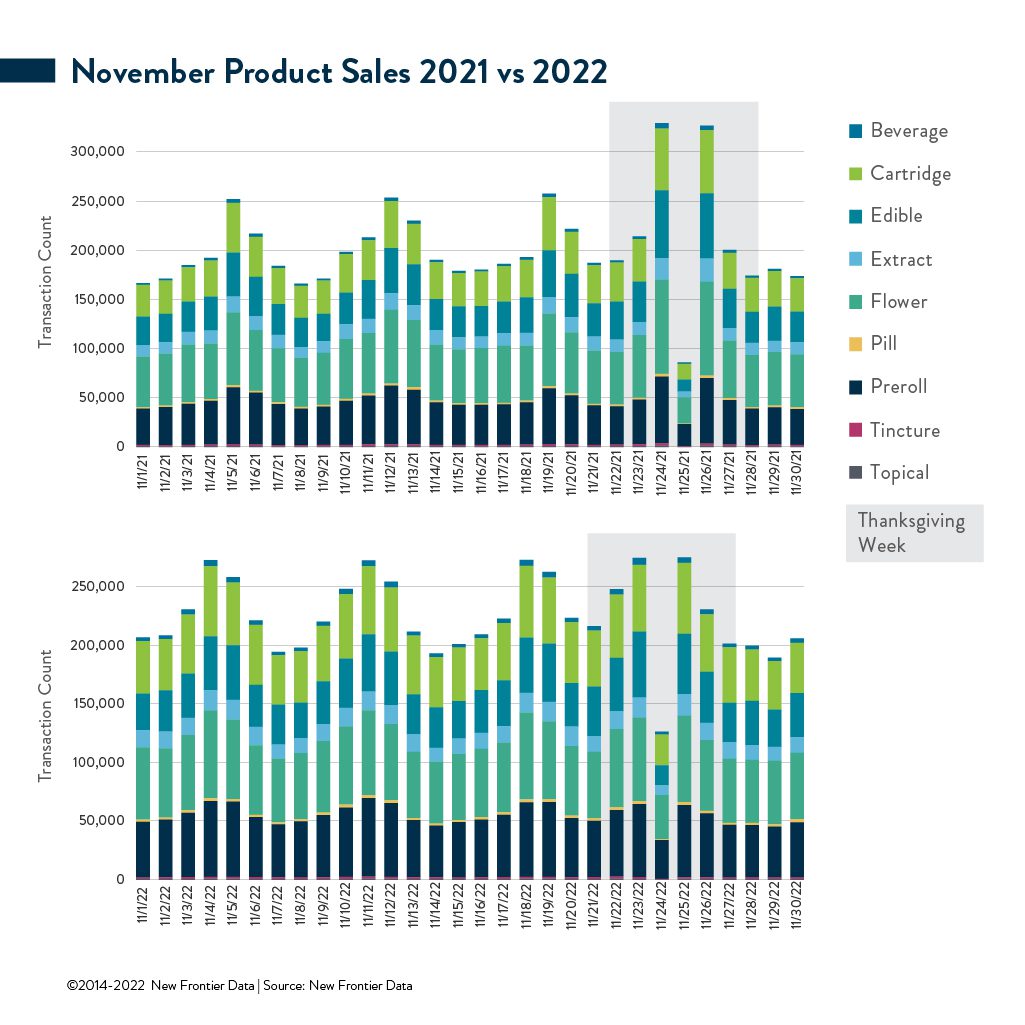

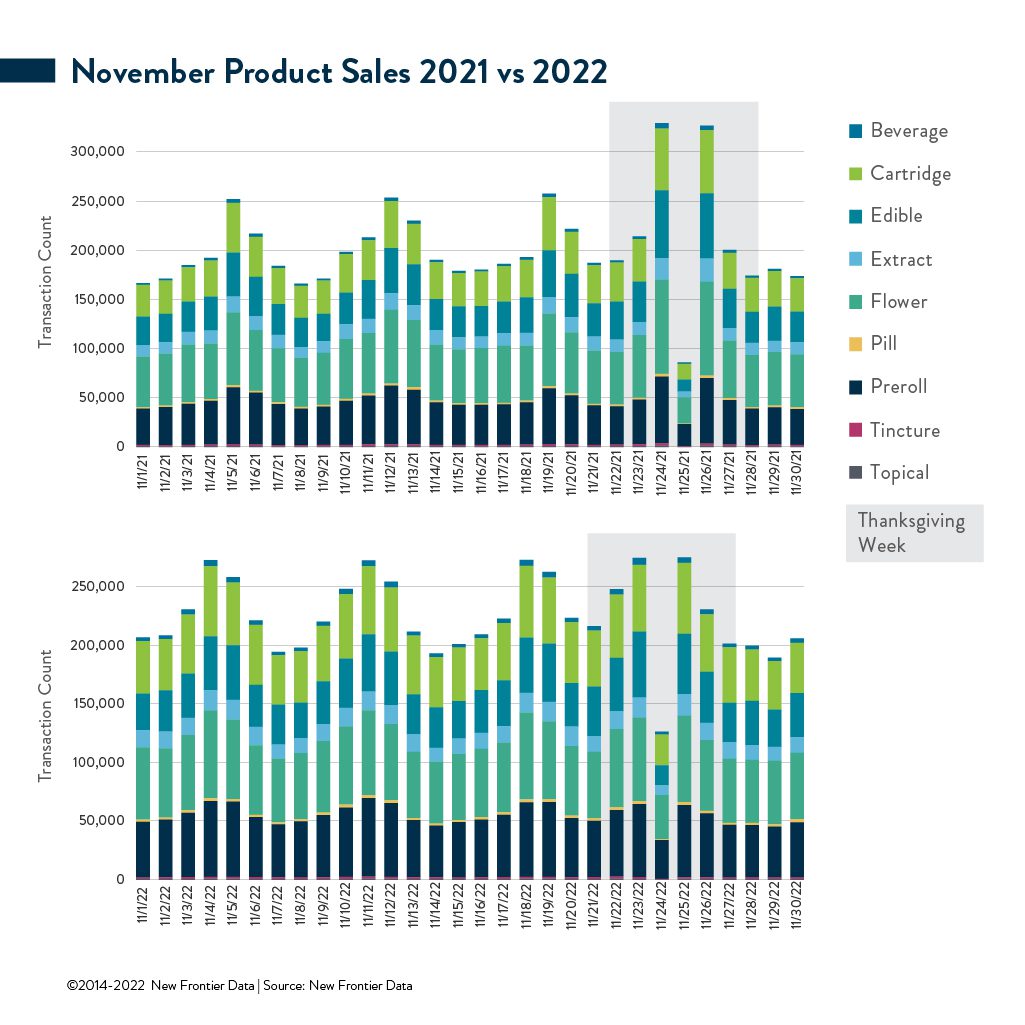

That’s backed up by some of New Frontier Data’s latest stats: “Perhaps the most notable difference in November was how Michigan’s product breakdown stayed similar throughout the month, where in 2021 they favored more edibles and cartridges right before the holiday,” explains Noah Tomares, Senior Research Analyst. “It’s striking how much more stable Michigan is in 2022 versus what it was ’21, and how much more it looks like California.”

What’s really interesting about these latest Green Wednesdays, he explains, “is seen through purchasing behaviors. In California, a relatively mature market, purchases remained largely consistent in terms of product breakdowns year-over-year. Michigan consumers last year gravitated towards more subtle or ‘family-friendly’ products such as cartridges and edibles: In 2021, those products spiked from 37% of transactions during the first week of November to 43% for the week of Thanksgiving. This year, the month looked much more normalized, with cartridges and edibles accounting for approximately 40%+ of sales during each week in November.”

Indeed, consumers in those two markets might simply have bought their cannabis in advance, like other holiday purchases this year. American holiday shoppers plan to spend an average of $1,455 this holiday season, according to a study by Deloitte, in nearly a dead heat with last year, when the average shopper reported spending about $1,463.

“I think it’s normalization and increased access nationwide that is driving the change in holiday purchasing,” suggests our Chief Knowledge Officer, Dr. Amanda Reiman (Ph.D, MSW). “Not only are people just more comfortable using their regular products in more places and with more people, but cannabis is available in more states, so there is not as much need to stock up before you go if you can get it wherever you’re headed. Many folks would likely rather wait and buy cannabis at their destination than to take it on a plane.”

Across the past three years, active adult-use markets since 2020 show much more legal access nationwide, as the number of active adult use markets has grown every year.

“That creates a scenario of fewer people having to go to more limited numbers of shops to supply themselves, their friends, and family over the holidays,” Reiman adds. “It also alleviates the need to get everything you need for three or four days before traveling. For instance, people do not usually buy all of the alcohol they will consume over the holiday before traveling and bring it with them to their destination. The data also show that there is not a huge change in the types of products people are purchasing leading up to Thanksgiving, but instead a small spike for grab-and-go items like pre-rolls on the holiday, even though that is a slow day for sales overall.”

The Thanksgiving holiday also likely underscores how friends and family are a major source of cannabis, notes Dr. Molly McCann (Ed.D.), our Senior Director for Consumer Insights.

“A ton of cannabis is shared through these channels — 44% of current consumers report sourcing from friends/family, while 29% say it is their primary source,” she explains. “In medical-only and illicit markets, friends and family are the leading primary source of cannabis, with 34% and 35% respectively getting most of their cannabis from friends/family. Similarly, 43% of consumers report providing cannabis to their friends and family.”

McCann adds that most (68%) of consumers at least sometimes use with others, and that sharing with family is not uncommon: 21% report consuming with siblings, 19% with extended family members, 11% with their parents, and 6% with their children.

“Even for those who don’t consume with family, most don’t hide their use,” she notes. “85% of consumers say their family knows about their cannabis use, and a majority (59%) say their family is generally supportive of their use.”

Meanwhile, Thanksgiving-adjacent activities are commonly accompanied by cannabis use: 40% of consumers report spending time with family/spouses while/after consuming, 38% report pairing cannabis use and eating, and 33% say that they combine cannabis and cooking.

Tomares agrees: “We expect that as markets continue to mature and new markets come online, consumer preferences will become increasingly normalized, and acquisition of cannabis will become increasingly integrated into consumers’ daily routines. Already, 48% of consumers report just visiting a dispensary after they run out, as opposed to planning a dedicated trip. With new markets opening with lower barriers to acquisition, consumers may feel less pressure to purchase cannabis before travel or social events. As this plays out, we may see some unofficial holidays playing a less significant role in consumers’ purchase decisions.”

Retailers looking to adapt to the latest sales trends and purchasing behaviors should consider subscribing to Equio®, our cannabis business intelligence platform, to put the data in context. In addition to our straight point-of-sale data in the Retail Suite, and five dashboards of interactive data widgets included in base subscriptions, we give Equio subscribers access to extended analysis and expertise on the data displayed — something that our competitors don’t necessarily provide to the same extent.

See for yourself: Download a complimentary copy of our Cannabis Consumers in America report. Interested in accessing Part I of the report series? Purchase an Equio® subscription to gain access to New Frontier Data’s entire library of Analyst Reports, and our five dashboards of interactive data widgets connecting you to the best-in-class retail, consumer, and market intelligence.

Perhaps the coolest tool in the dashboard kit is our U.S. Opportunity Index widget and corresponding map filter to provide a uniform metric of opportunity across state markets. Those are particularly valuable given the varying regulations/taxes/license caps/market types across states due to a lack of federal oversight. So, we not only provide retail point-of-sale data at the same levels, but also deliver a more comprehensive look at the entire market, which we have been covering since 2014. You want customers; we know those customers.